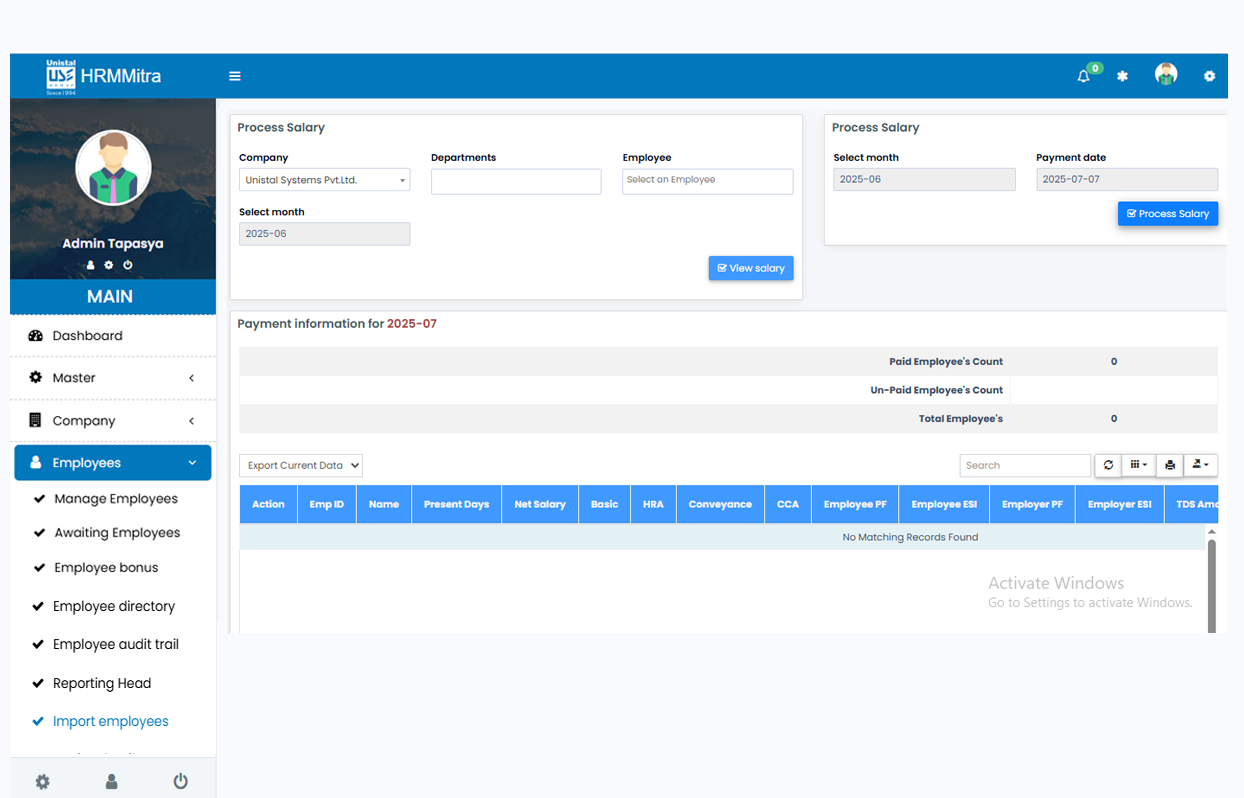

HRM Mitra's Payroll Management Software is an integral part of its HRM Solution and is designed to ensure accuracy, efficiency, and statutory compliance in payroll processing.

Accurate salaries with zero manual effort

Smarter tax handling, built right in

Make payroll fit your policies

Give employees control over their payroll data

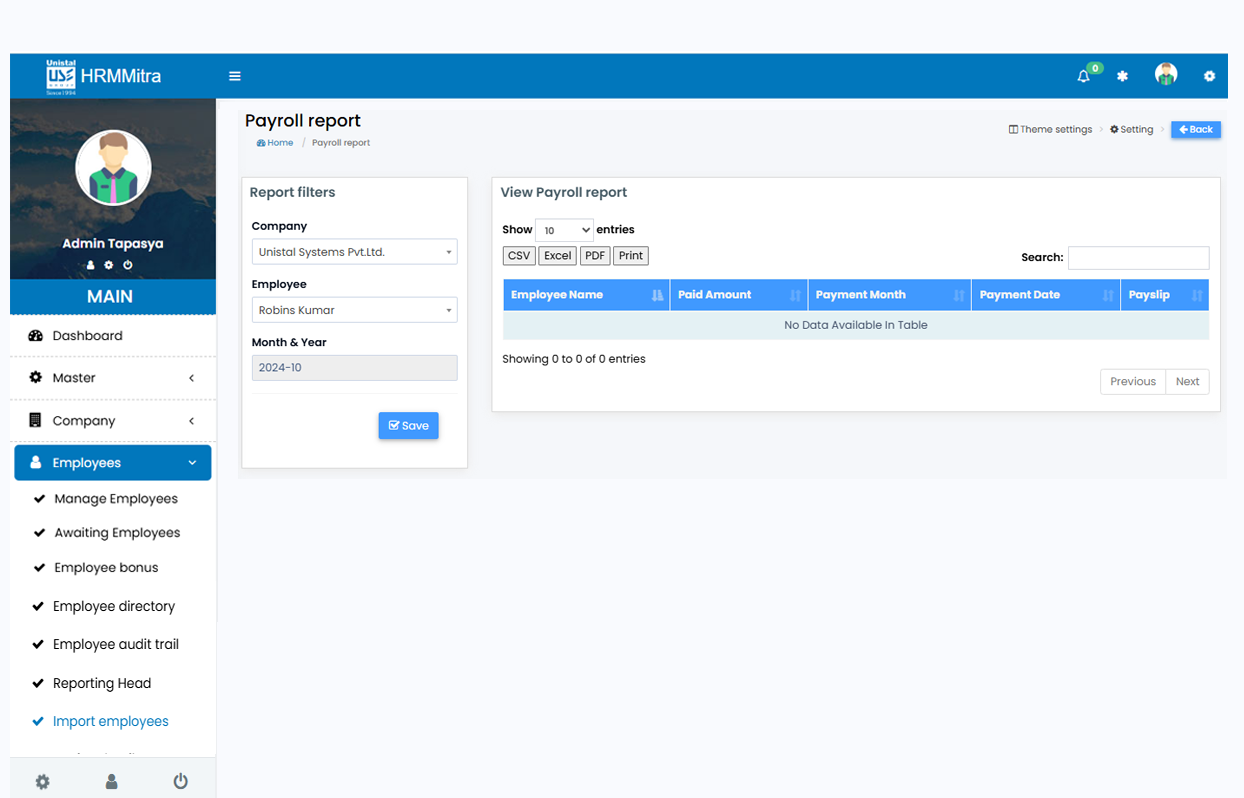

Hassle-free salary disbursement, every time

Always aligned with legal and tax norms

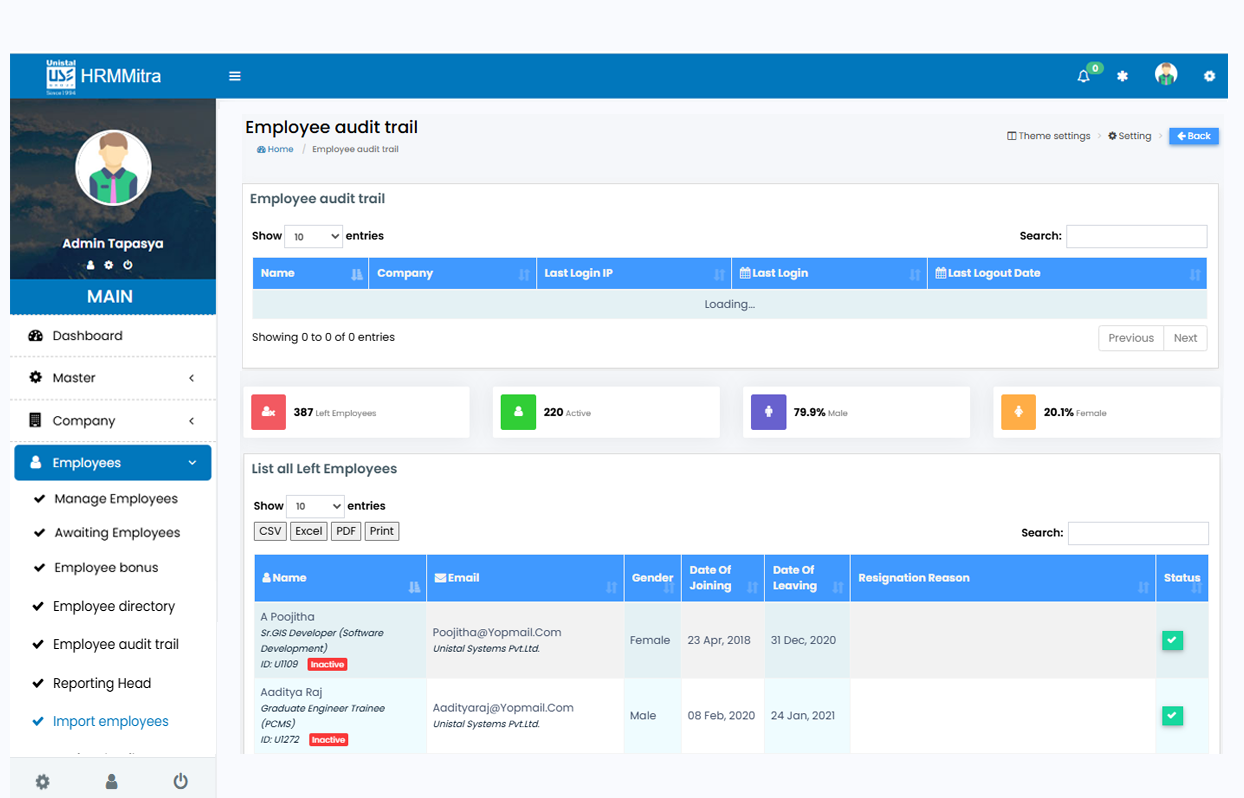

HRM Mitra auto-calculates employee salaries by integrating attendance, leave, overtime, and incentive data. It factors in income tax, TDS, bonuses, arrears, and cost-to-company (CTC) components configured per pay head, eliminating manual input errors.

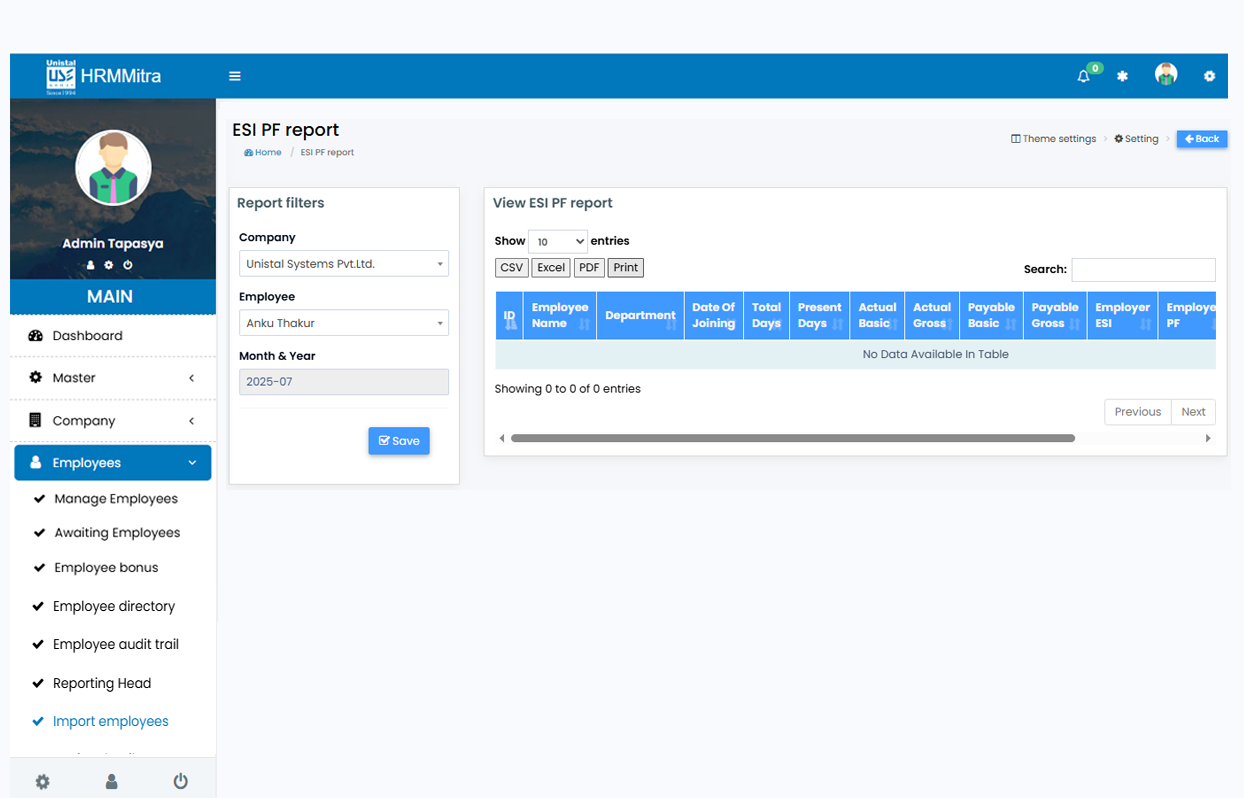

HRM Mitra supports thorough compliance by automating TDS and income tax calculations, generating statutory reports like Form 16, and staying up‑to‑date with local payroll laws, minimizing compliance risk.

Absolutely. The integrated self-service portal and mobile app let employees securely view payslips, salary breakdowns, tax deductions, and bank remittance details, boosting transparency and reducing HR queries.

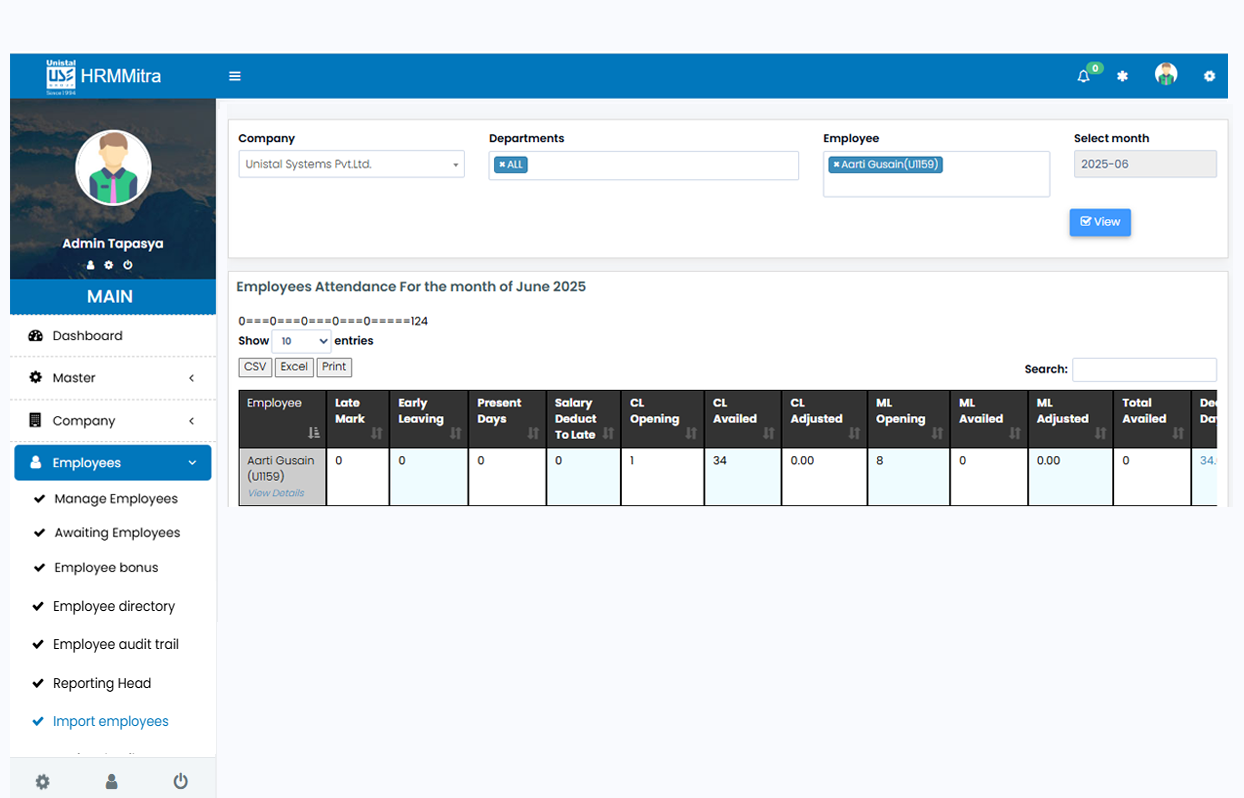

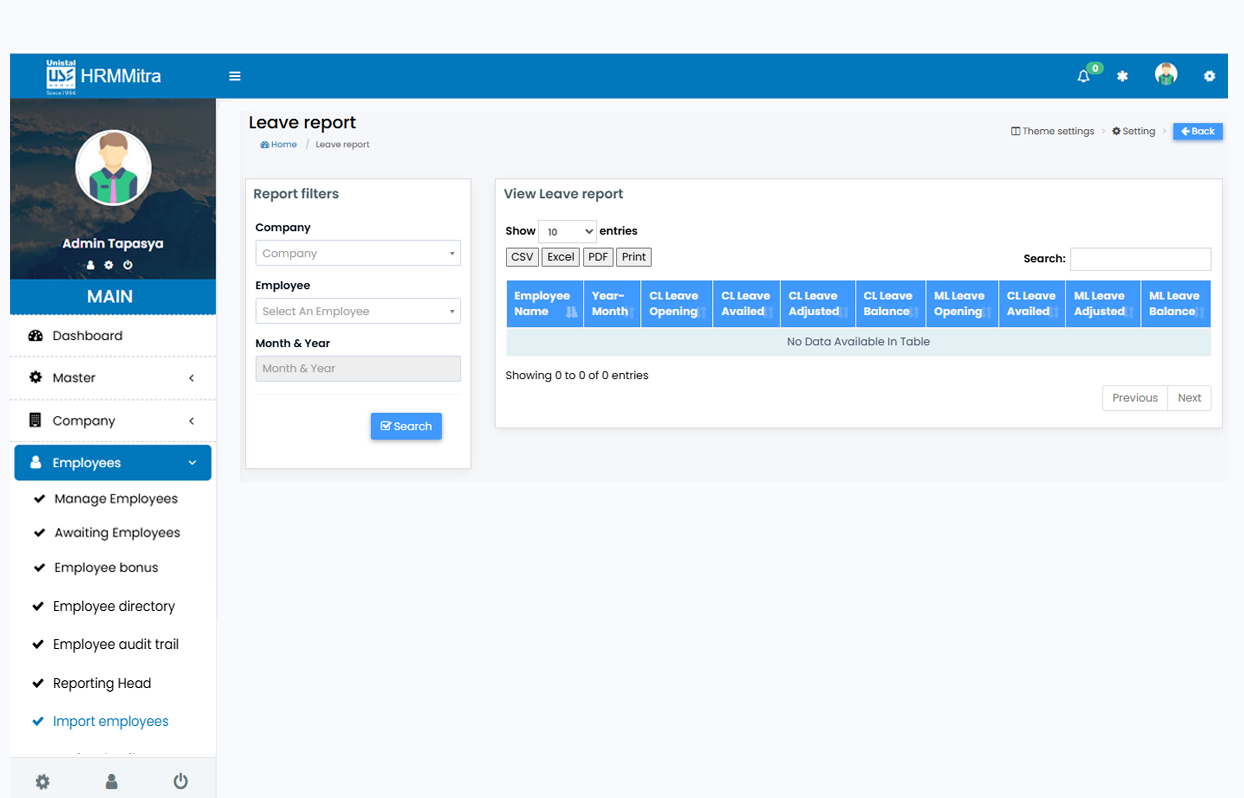

Payroll is tightly linked with the attendance and leave modules. Approved time-offs and biometric or GPS check-ins feed directly into payroll logic, ensuring accurate pay calculations without manual reconciliation.

HRM Mitra delivers detailed payroll reports, including payroll summaries, cost center breakdowns, tax reports, and bank CMS files for payroll disbursal. It also provides real-time dashboards on labor costs and compliance metrics.